Gold and Silver Price Review - June 2018

Synopsis

We take a look at the main events to influence gold and silver prices this month.

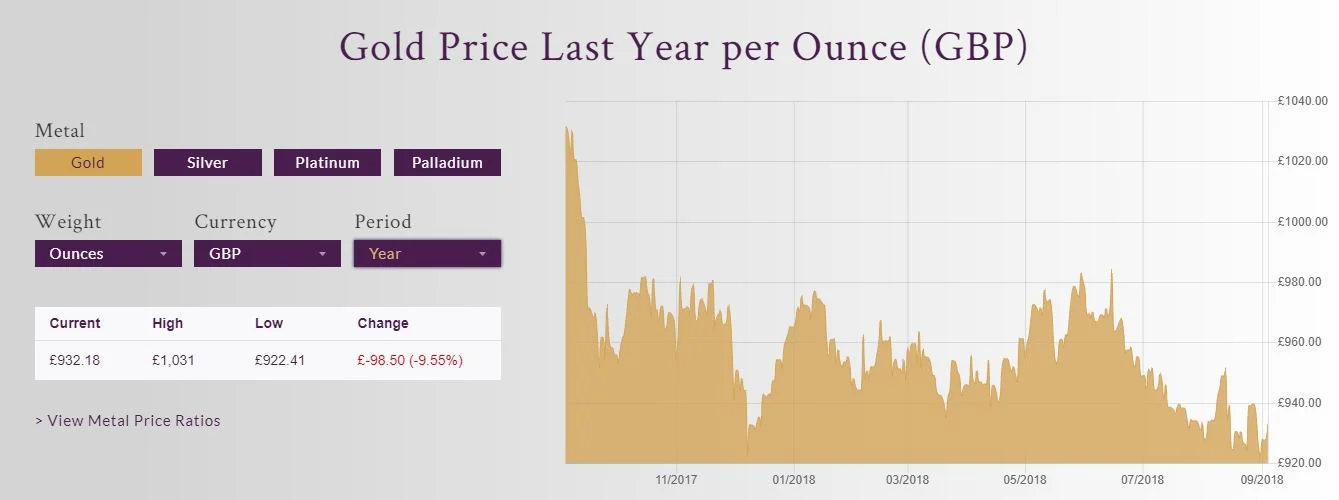

Price Highs - Gold @ £982.47 and Silver @ £12.95

Price Lows - Gold @ £922.40 and Silver @ £11.19

Trade Wars - with the Trump presidency in full swing we await to see the full effect of the escalating trade wars. The trade wars are being fought predominantly by the US, China and Europe with the prospect of huge tariffs being applied to exported goods. Threats of tariff increases formed part of the presidential manifesto in order to repatriate jobs and Trump has been under increasing pressure to act. Plans to impose the first tariffs on China were scheduled for 6th July unless China "changed its business practices" . This rocky journey to repatriating jobs could affect large swathes of the working American population!

As a result of the trade wars China's stock market took a dive which can be seen on the Shanghai composite index. Looking at the previous 12 months we can see a significant drop since the January highs equating to roughly 24%. The FTSE 100 took a hit around March time but has since recovered as has the Dow Jones and S&P 500. The ongoing trade wars appear to be affecting China more so that the US and EU (granted there are more variables at play than this one tit-for-tat event)

It remains to be seen whether the trade war rhetoric and tariffs will cause a global recession but we are watching the price of gold closely.

Dollar Strength - the price of gold has been generally decreasing in GBP and one reason is the strength of the USD. As gold settlements are paid in dollars a weakening pound or strengthened dollar means you get less gold for every pound you spend. With the strengthening dollar, bonds become more attractive and some investors will even move away from precious metals, pushing the price down further.

The Gold Slump - with prices falling many commentators have taken a bleak outlook claiming the end is nowhere in sight for gold and occasionally making out this is also something to do with the growing popularity surrounding cryptocurrency especially during the Bitcoin peak in January 2018. We believe this mindset is reckless and that it is often normal for prices to fluctuate and normalise. What's to say gold was not hyped up and too expensive? Dominic Frisby of Money Week carries a more optimistic view reporting the slump but also that this slump can encourage investors back into precious metals. The swings between high and low demand are trademark of any free market and the lows simply appeal to the bear investor rather than the bull. Ross Norman of Sharps Pixley puts it well that markets have a corrective mechanism which is the price itself! The lower price attracts bargain hunters and in a great quote "Gold has been looking so bad it’s starting to look good!" .............With this said the bear market can quickly turn on its head into a rush!

You may wish to read more articles in our market news section.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.