When Should You Buy Gold?

Synopsis

A question we get everyday is 'When is the right time to buy gold?'. Here's some information from Chards, which has over 55 years' experience of bullion trading.

When Is the Right Time to Buy Gold?

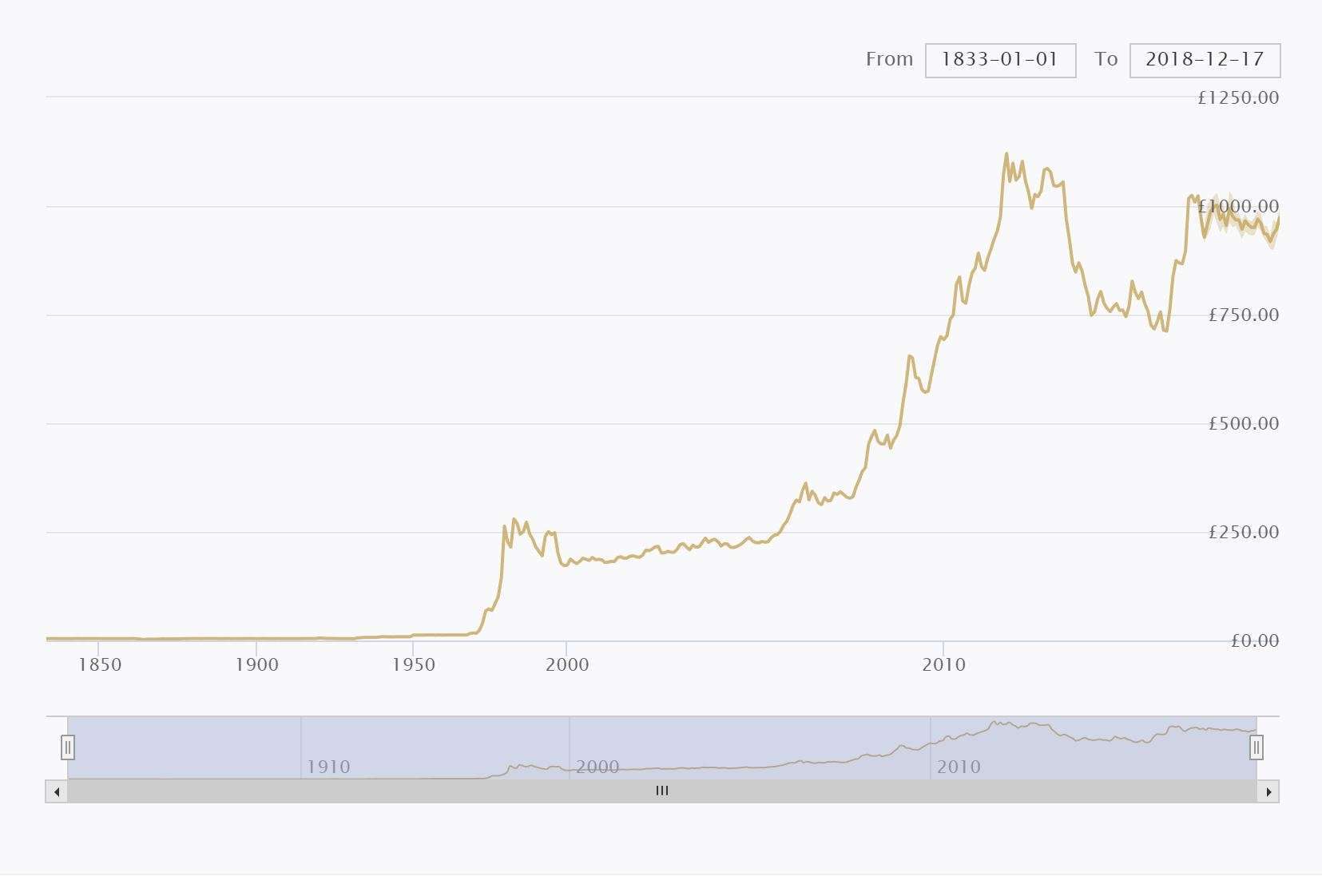

Since the 2000s, gold has seen an exponential rise in value. If you were already trading in the yellow metal, no doubt you saw your stock value increase exponentially. Not only that, but the cash balance required to purchase stock and continue dealing also increased.

Those savvy investors who already owned gold before the financial crash of 2008 would have seen their investment grow in value roughly 4 to 5 times depending on exactly when gold was purchased. On the other hand, those buying during the bull run of 2011-2012 may end up admitting that the timing of their investment was poor. All investors should be aware of market bubbles and try to steer clear where possible. The bull run climax in 2011 was initially sparked by the financial crash when global events spooked equity and financial investing with many private individuals and funds ploughing money into precious metals. Price rises would be smaller without media and newspapers, who have a tendency of inflating facts and stirring the market to push prices even higher!

We mention these scenarios as, if you are not intending to trade your investment gold regularly, timing is everything!

Buy When the Gold Price Is Low!

It goes without saying that you should aim to buy gold when gold price is low and sell when it is high. Doing this successfully requires you familiarise yourself with the live gold price, all time historic prices and even the gold silver ratio.

Live Prices and the Gold to Silver Ratio

The gold to silver ratio is how many ounces of silver you can buy with one of gold. High values of 70-80 could indicate an over inflated gold price whereas low values could indicate gold is too cheap. The reverse applies to silver and you should analyse the price information, historical prices and current affairs to reach your own conclusions. You can read more on our gold to silver page.

Gold as a Long Term Investment

Here is our gold price chart for the past year which also shows the highs and lows across each timepoint.

Cyclical Gold Market Trends

You can see that not only does gold have a daily min and max price, but it also fluctuates across the months. It is normal in any market for prices to fall and then rise and the gold market is no different. The price fluctuations depend on a plethora of wide-ranging factors from mining activities, consumer and industrial demand, politico-economic uncertainty, amongst others.

Given the ongoing Brexit calamity in the UK, global economic slowdown and the Sino-American trade war, we see no end in sight to the uncertainty that pushes gold prices higher.

Over the last 25 years, gold has seen an almost month on month increase but throughout this time several price corrections have taken place. Most notably the price correction of 2013 which saw prices plummet by over a third! If you were fortunate and invested before the price rises (2008-2010) the correction would pose little worry. However, if you had bought when prices were high in 2011/2012 and sold in 2014 you would likely be at a loss.

We mention this as if you had the nerve to hold onto the stock and sold in July 2016 prices had recovered to within about 10% of that of the 2012 peak. Not only should gold be a long-term investment, we would also be very wary investing if the market shows signs of a bubble with over inflated prices.

Gold's Long Upward Trend

Month on month gold price has increased over time and we have bought and sold gold constantly over this period. We always believe it is a good time to buy gold and not a single day goes by where we don’t invest in either gold coins or gold bars. As a business price changes do not affect us in the same way as a private individual as we trade gold bullion the same day as we buy it! We try to sell our bullion stock as soon as we can as holding on too long can pose a risk if prices were to drop. On the flip side, hoarding while prices increase is ideal but we dont have a crystal ball to predict this. If you are looking to make a quick profit out of gold, you will have to be opportunistic in the market as returns with gold are usually small relative to stocks and other investments as gold is usually used as a long term investment and a hedge against inflation. If you are inclined to invest in gold for the short term, we invite you to read our gold investment guide, live prices and ratio pages to time your investment to make a profit.

We would recommend you buy smaller amounts over time, which helps spread the risk of price fluctuations. That is unless the price is very good, and you wish to invest all in one go. It might not be possible for you to invest everything in one go and you may want to spread a £200,000 purchase over a year for example. Do be warned that prices can also go up and investing in smaller amounts may ultimately not be the right choice.

Regarding selling your gold we also advise selling at smaller quantities as price risks are spread you can also be more reactive to market price swings. Some investment gold products are NOT capital gains exempt and as such when you sell the value is added into your CGT total. If you were to sell all your gold in one go you might find you break the threshold for capital gains tax. This is currently a profit of £11,300 (as of 2018) and if you exceed it you'll end up giving your hard-earned money to the government! However, if you were to part sell each year you could realise a profit up to the threshold each time making for more returns (assuming a constant gold price).

Whether buying or selling you need to watch the live gold price and our charts work across desktop, mobile and tablet so you can keep up to date wherever you are. Some investors are happy to buy whenever and in any quantity, a bit like us! Finally, it all depends on your personal position and financial requirements at the time which avenue you will choose.

If you want to talk to one of our friendly members of staff for more advice or product suggestions, please call 01253 343081.

Global Uncertainty and Financial Risk

Global political tensions and financial unrest usually cause the price of gold to increase. This is due to demand for the metal increasing as outflows from equities and financial markets are ploughed into precious metals. The 2008 financial crisis saw prices of precious metals sky rocket as contagion from Lehman's collapse took hold across the globe. Prices increased 4 or 5 times and broke the £1100 mark in 2011 for the first time in history!

Buying Gold When Times Are Hard

We invite you to read about current affairs in our market commentary section and learn how world events can trigger price movements in gold. If you spot an opportunity you may be ready to buy gold. So, carrying a cash balance to do so is advisable or a very liquid asset you can sell to invest in gold. If you’re looking to buy gold now, why not compare different products to see which gives you the most value for your money and buy from us? We have won bullion dealer of the year 4 times running and as such are considered the UK's no.1 Bullion Dealer as voted by you! We have been in business for over 50 years and offer market beating prices on most products. Our secondary market gold is sold at our lowest possible premiums!

Here are two of our most popular secondary market products to buy:

Gold Sovereign Best Value Coin - Secondary MarketStock Status - In Stock

|

1 oz Gold Bullion Coin Best Value - Secondary MarketStock Status - In Stock |

Conclusion

We want to remind all potential and active gold investors that gold should be a long-term plan and not a short-term profit game. Huge profits are often not realised but gold holds its purchasing power over time, which is more than can be said for the pound or US dollar. You may be one of the fortunate ones, if you buy when the price is low and make a profit, but please be humble and take this win for what it is and not as a predictor of future success. Taking your money out of the clunky banking system and taking physical delivery of your gold is the best way to protect your wealth in today's gloomy and uncertain economy. The saying "if you don't hold it, you don't own it" comes to mind. If you are unable to store large amounts of gold in the home why not take advatange of our state of the art storage facilities.

Research, research and do more research! Read our site (and others) and take advice and market commentary from long established bullion dealers. Figure out which sources you can trust and find a reputable dealer you can trade with honestly and discreetly. If you are going to be storing your own gold, you don't want everyone (or anyone for that matter) knowing that you have it in your home. Focus on your long-term position and watch the live prices regularly so you are poised to take advantage of market movements should they happen. You may even want to bookmark our live prices page!

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.