Newbie Information and Advice - For New Collectors, Investors and Stackers

Synopsis

Our advice page for people thinking about starting to collect, invest, or stack coins or precious metal bullion, whether gold, silver, platinum or palladium.

We give answers to frequently asked questions, and help you to avoid pitfalls and common mistakes, providing an essential guide before you start laying out your money.

Where to Start and How We Can Help

People ask on a daily basis for advice on buying gold and other coins, bars etc.

In the pre-historic early days of the internet (1998), I started to add advice and opinion pages to our "new" website. That website now looks like it belongs in a museum, and not all of the old content has been ported over to our newest site.

We have more than 50 years experience of typical questions that newcomers have. We also see the same questions on coin bullion and investment forums.

First, ask yourself some questions:

What is your prime goal?

Interest in the historical or numismatic aspects of coins;

Investing to make a maximum return;

Investing to protect wealth against inflation, etc.?

What are you most interested in?

Coins as numismatic items,

the precious metal content of coins and bars?

Metal Preference? Most Interested in:

Gold;

Silver;

Platinum;

Palladium;

Open minded?

Budget

How much do you intend to invest?

Lump sum or regular purchase?

Timing

Want to start now, or ASAP?

Wait until prices come down,

wait until prices go up?

Home Base

Where do you live, which country, state, etc.?

Legal considerations - Is what you want legal to buy or import in your country?

Tax considerations:

In the UK and EU, “Investment Gold” is exempt from VAT.

Other precious metal coins and bars are subject to VAT in the UK and EU.

In the USA, there may be sales tax in some states.

Secure Storage

It is worth thinking about how and where you intend to store your stash.

For small amounts, this might not be much of a problem, but for higher values, you might need to think about a safe, alarms system, and insurance. Some banks may still offer safe deposit boxes, and safe deposit companies also exist. Check whether your insurance can include these. Alternatively, some companies now offer secure storage usually including insurance. If the storage is in a favourable tax regime, this may also legally avoid VAT on silver, platinum and palladium. Charges vary.

Bear / Bull Market Cycles

Very few people can accurately forecast future precious metal prices, including many people who think they know. If you don’t know, then you are not alone, and at least you are not deluding yourself that you do know.

Relative Merits of Gold, Silver, Platinum, and Palladium

As a UK based dealer, we obviously concentrate on the UK market, but we do have a number of non-UK customers and suppliers, so while we are aware of some international markets, most of our thoughts relate to the UK.

Gold is the only one of the four precious metals which is exempt from VAT in the UK and EU, so it is the most obvious metal to choose for investment. Its unique VAT status is probably because it has historically been a monetary metal, renowned for retaining its value, and a range of other factors.

Silver is the other historic monetary metal, but because it is subject to VAT in the UK and EU, we do not recommend it as a prime investment metal. It does have its enthusiastic supporters though, and it is relatively affordable.

Platinum and palladium are the other two precious metals, although both metals are newbies compared with gold and silver. Both are also subject to VAT.

Gold:Silver and other ratios.

The ratio of gold to silver prices has had a profound influence on monetary systems for thousands of years, until the last century, when “fiat” currencies have prevailed.

It is worth getting familiar with the current, and also historic gold:silver ratios. This will help you to decide between gold, silver, a different metal, or a combination.

Production Costs

Gold has a well-established international market, as does silver to a lesser extent, platinum and palladium markets are smaller and less liquid.

Mining is the most obvious production cost of any metal, but refining and other processing costs also come into play. Gold is cheap and easy to process in relation to its value. Silver is worth much less than gold, but the cost to manufacture a one ounce coin, for example, is not much less than for a similar gold coin, which explains why the percentage premium for silver coins or bars is generally higher than for gold. Platinum and palladium are more difficult to process, so their percentage premiums are also usually higher than for gold. Transport costs are also a higher proportion for silver than for gold. Silver requires more space to store compared with its value, so storage costs are also higher.

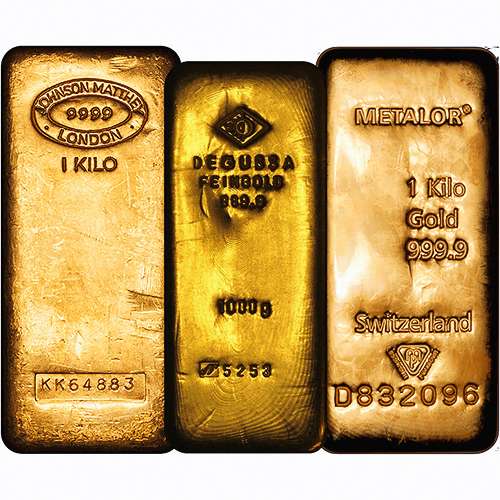

Coins or Bars?

We are primarily coin dealers, so we prefer coins, but there are other good reasons to choose coins rather than bars. Coins have tax or legal advantages in many countries compared with bars. Coins are issued by countries, bars by companies. I hesitate to suggest you trust governments rather than companies, but think about it. Coins are mass produced, and are usually available in a selection of different weights at competitive prices. One ounce coins are a universal choice in modern bullion coins, and hit a “sweet spot” for premiums, but historic coins such as British gold sovereigns (approximately quarter ounce) are also available competitively. Many other countries have their own traditional historic coins which are worth considering.

Bars are also made in many sizes, and you should expect to pay slightly lower premiums for bars rather than coins. The biggest “small” gold bar is one kilo, and should usually be the cheapest bar to buy (in percentage premium terms), however the differential is quite small, and for most investors, smaller sizes such as one ounce, as a better long-term buy. They are more liquid, as more people can afford them, easier to post (and insure), an important consideration when you want to sell.

Premiums

Whenever I talk about premiums, unless otherwise stated, I mean percentage premiums. This is the simplest way to compare value. If you don’t understand percentages or simple maths, then I recommend getting a few quick lessons, and a little effort. Education is always a good investment!

We are one of the few UK dealers who show premiums on their product pages. Not only that, but we also show the intrinsic value of the product so you know exactly how much you are paying above the spot price.

My General Advice

Buy at the lowest premium within reason. If you have read most of the above, you will understand what I mean, and why.

Changes

Most of the advice I give is generalised. There is a good reason for this. Things change. When I wrote this paragraph heading, I started singing the David Bowie song. Markets are constantly in a state of flux. For this reason, what is good specific advice on Monday morning might not be the same by Friday night. Changes occur over long timeframes of centuries and decades but also happen on shorter timescales of years, months, weeks, days, hours, and even minutes. Gold went up about $10 in a few seconds after the first plane hit on 9/11.

These changes include political, financial, fiscal, personal, local, international.

News and Hype

I spend a lot of time reading news. I call it working. In recent years, I have become more aware that most of what I read is written by vested interests, lobby groups, “influencers”, and the like.

It is not easy, but try to discern whether facts are accurate, and to work out whether the “news” is coming from an “interested party”. It is often easy to detect hype and bullshit. Be aware that we are all prone to believe what we want to hear rather than what we do not want to hear.

Big Spenders and Small Savers

If you have big money to invest, you should have more choice of “best buy” deals.

If you are a small saver, it will be harder for you to get the “sweet spot” for value, so you might have to work a little harder.

Big Dealers or Peer-to-Peer

If you want to buy 100 ounces of gold, then almost everyone would agree go to a big, reputable dealer. Chard in Blackpool, England are not the biggest, but are one of the best (I am biased). You can have confidence that what you are buying is genuine.

If you only have a few hundred dollars (more or less) to invest, then you might actually get the best deals shopping around, perhaps on a well-known forum. It is not quite as easy to be certain that what you buy is genuine, but as I said, you may need to work a little harder.

You may be able to find a dealer or scheme which will let you buy small amounts of gold, silver etc., regularly, then switch it into physical when you have enough metal in your account.

Who, What, and Where to Avoid

Although it is possible to buy on eBay, it is fraught with danger, riddled with fraudsters, ripe with hype, and probably better avoided, unless you like a gamble. Similarly with other auction sites, and private advertisers.

Local auctions can work, and are probably better than eBay, after all it wouldn’t be difficult.

Local coin dealers might work out for you. Jewellers, pawnbrokers and scrap dealers are probably better avoided. Often, they don’t know and don’t care if coins are genuine, and many of their coins are sourced from scrap jewellery, and are sub-standard.

Coin Marketing Companies (CMCs)

You will see national newspaper and television adverts for these. Most of them market brand new coin issues at (high) premium prices. Many of these are very gimmicky, the world’s first, biggest, smallest, weirdest, latest, rarest. If you want to buy this stuff, then reading what I say will probably not stop you, but make sure you really want to buy it, and don’t be surprised if nobody is interested when you come to sell, even at half your cost price or less. Most of the CMC’s do not make a market, and will not buy (or buy back) coins, possibly because they don’t want you to realise they have ripped you off.

Some CMCs offer introductory deals (only $49.99 for the next 30 days, $99.99 “normal” price), others do loss leaders, usually restricted to 1 coin per household. This is to get your name on their “suckers” mailing list. They may also try the highly unethical, sometimes illegal, “bait and switch”, in which your personal account manager will try to convince you to buy pre-1933 gold coins telling you they are non-confiscatable. Ask yourself has he really got your best interests at heart, or is he trying to boost his commission, or keep his job?

The guy at the local pub

Also best avoided!

New Coins vs. Old Coins

It is not necessary to buy brand new coins straight from the mint. You will normally have to pay extra for them, and they are not necessarily any better than secondary market coins.

Whether you buy old or new, when you come to sell them, they will be second-hand, so you may only get the same price for them. You are certainly not guaranteed to recoup the extra premium you paid for shiny new coins.

In high demand periods, secondary market coins are often in short supply, meaning you may have to pay more for newly minted coins

Traditional Coins or Modern Bullion

Krugerrands, introduced in 1967, as a one troy ounce gold coin, spawned a whole host of me-too bullion coins including the Canadian Maple, Mexican onza,, Manx angel and noble, America gold eagle and buffalo, Australian nugget, kangaroo and lunars, United Kingdom gold Britannia and lunars, Austrian Philharmoniker, Chinese panda. Most of these are also issued in fractions and multiples of an ounce.

Before Krugerrands, many countries had issued gold coins for circulation. Many of these are still available, often at lower premiums than the “new” breed or troy ounce coins. This makes them arguably a better buy, and you can also get numismatic or historical value thrown in for nothing.

In high demand times, these traditional coins often become harder to obtain than normal, forcing you to choose between waiting or paying more for “new” coins.

You can read more on our Real Gold Coins or Bullion Investment Coins? blog.

Errors and Omissions

If there is anything we have missed out, please let us know.

If there are any other questions you would like answering, please submit them on the back of a £50 note, $100 bill, €500 banknote or similar!

Seriously, if you have questions we have not answered on this page, please let us know.

You can also contact our amazing customer service team who will be glad to help.

Related Articles

Popular Products

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.