Why You Should Buy Physical Gold

Synopsis

This is true ownership. You can touch and feel what you have bought. Good luck getting your gold coins and bars in a hurry from a vault in Switzerland, if you need to pack your bags and go!

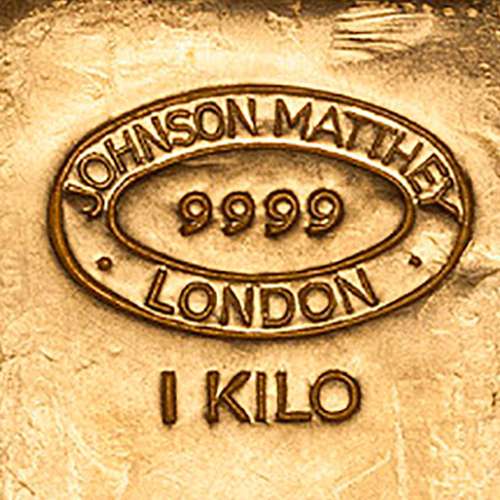

Buying Physical Gold

In times of economic uncertainty, gold is seen as the traditional safe-haven and physical gold ownership is often seen as the preferred option. This asset is a good insurance against inflation and is a protection against economic collapse. Gold is a commodity that will always have a value and as banks and governments push us towards a cashless society, it is a good idea to have an asset which is not linked to the financial markets, per se.

The 2008 Financial Crash

In 2008, four British banks nearly triggered a complete banking collapse. There was a run on the bank of Northern Rock and many investors saw their savings wiped out. Similarly, the sub-prime mortgage scandal in America led to the closure and collapse of banks and investment firms. The real victims were the investors who had relied on these banks to protect their savings. With Brexit, the Eurozone project, spiralling government debts, plummeting currencies and increased levels of social unrest, gold and silver are the best way to protect your wealth.

Although gold can be volatile, investing in physical gold gives you control of a physical commodity that lets you hedge against financial stress. We can help you add gold to a new or existing portfolio just get in touch on 01253 343081 and speak to one of our friendly members of staff.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.