What to Buy Silver Coins or Bars?

When it comes to the question about whether it is better to invest in silver coins or bars, our answer is always the same that it depends on the needs and requirements of the individual investor.

We go into detail on this page for you on why you should buy silver coins instead of bars. We are a fan of coins over bars and you will see why...

When investing in silver it is important to know the difference between coins and bars and how these differences can be used to make an informed purchase. Educating yourself on the differences can help maximise your investment value and make it easier or more efficient to sell in the future.

Coins

Coins are produced on behalf of a ruling party or government meaning that not only do they have the status of legal tender, but they are also usually finished to a high standard. Most coins have their purity and weight inscribed somewhere on the reverse, with the obverse featuring a face value, year and a unique intricate design which often varies from year-to-year.

Coins are produced on behalf of a ruling party or government meaning that not only do they have the status of legal tender, but they are also usually finished to a high standard. Most coins have their purity and weight inscribed somewhere on the reverse, with the obverse featuring a face value, year and a unique intricate design which often varies from year-to-year.

Whilst coins do tend to be more collectable this can also mean that they tend to carry higher premiums, can sometimes have longer waiting times and there is an increased likelihood of fakes.

Bars

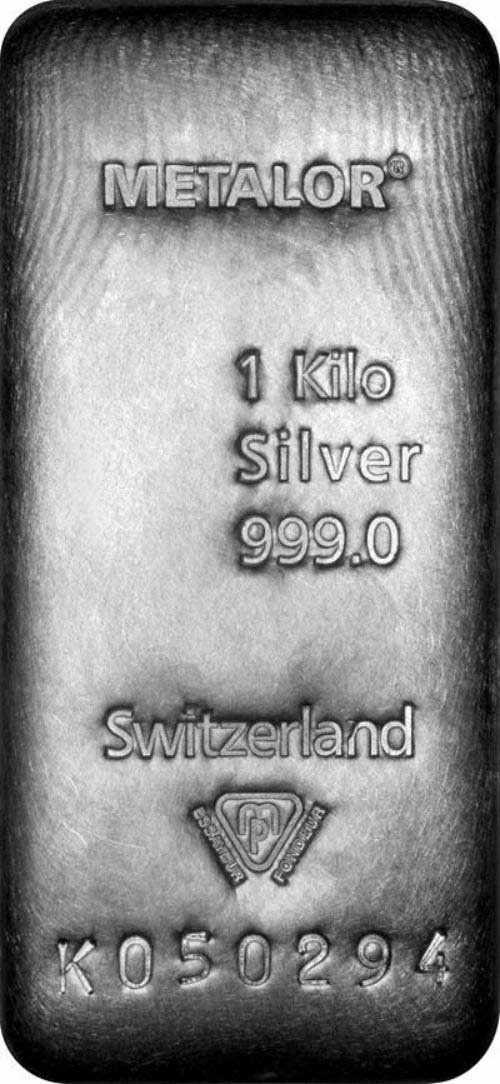

Unlike coins, bars are produced by private mints such as UBS, PAMP and Metalor meaning that they are not considered as legal tender. They tend to be quite uniform in appearance mostly as rectangular slabs inscribed with the manufacturers mark, weight, purity and on occasion a serial number.

Unlike coins, bars are produced by private mints such as UBS, PAMP and Metalor meaning that they are not considered as legal tender. They tend to be quite uniform in appearance mostly as rectangular slabs inscribed with the manufacturers mark, weight, purity and on occasion a serial number.

Although bars do not have the same collectability factor as coins they do tend to carry lower premiums, are compact and stackable so easy to store/transfer and are a great way for new investors to build their financial portfolio quickly.

Rounds

It may also be worth thinking about silver rounds. Most of the time these are similar to coins in their appearance but, like bars, are produced by private mints so are not considered as legal tender. This means that an investor can acquire precious metal in a coin like form but at a low premium.

More Things to Think About

There are several other factors to consider when deciding whether to invest in silver bars or coins including, notably:

- Product premiums

- Timescales

- Storage

- Buyback premiums

- Capital Gains Tax (CGT)

- VAT and special scheme silver

Product Premiums

Silver coins often carry a lower premium than bars and for this reason we recommend buying coins where possible. This is not to say that bars are not a good investment and they should be evaluated on the day.

Secondary market silver coins are usually the lowest premiums available, but we do occasionally have minty coins very cheap if we manage to source a good deal.

Timescales

Prices do fluctuate over time, so any investor should be aware that the value of their investment can go up or down. It's understandable that the longer you hold onto an investment the chances of prices changing increase but by how much and when is always a guessing game so don’t be fooled by hype and “predictions”.

If you do invest a large sum of money into an investment it can pay to make frequent transactions along the lifespan of your investment in terms of buying and selling. This pattern of transacting can help buffer any changes in prices. For example, if you invest £10,000 today and in 5 years the price is £2,000 you will be down £8,000. Say in the third year the price spiked before dropping back down to the £2,000 and you were carrying out frequent buying and selling you could take advantage of this. You could be selling at a high price and then buying more back in the future when the price has dropped. At the end of the 5 years it is likely you still have less than £10,000 but you certainly will have more than £2,000. If you had sold everything in the third-year spike and bought everything back later on you would end up with even more than £10,000. Keeping an eye on the silver price and market factors is so important and you can take advantage of opportunities as they arise.

One of the bonus points for coins is that they allow you to part with fractional amounts (e.g. 1 oz) of your investment rather than a larger amount (e.g. 5kg bar)

Storage

Any substantial silver investment is going to take up some serious space. Gold is some 45% denser than silver and as a result, investors usually require a personal safe or strong room as there is only a limited amount of space under the floorboards!

Any substantial silver investment is going to take up some serious space. Gold is some 45% denser than silver and as a result, investors usually require a personal safe or strong room as there is only a limited amount of space under the floorboards!

By popular demand Chards now offer storage services where all customers can take advantage of our high security strong rooms. All gold and silver bullion can be stored on site in Blackpool and you can read more on our storage page.

If you wish to invest in VAT free silver we offer storage in Guernsey where you can take advantage of fantastic prices if you are comfortable not taking physical delivery.

Buy Back Premiums

We will always make an offer to buy silver if you are selling. Our offer price is not fixed and will change usually to help regulate stock levels and meeet market demand.

If you store your silver with us we will offer you a preferential rate when you come to sell.

Buy back premiums change between products so do some homework and find out which products are most likely to get you a good rate.

| Product | We Are Currently Paying Up To: |

| 1Kg Silver Bar | £699.19 |

| 500g Silver Bar | £349.70 |

| 250g Silver Bar | £184.00 |

| 1 Ounce Silver Coin | £22.89 |

| 30g Silver Coin | £22.08 |

| 2 Ounce Silver Coin | £45.78 |

| 5 Ounce Silver Coin | £114.46 |

| 10 Ounce Silver Coin | £228.92 |

| 1 Kilo Silver Coin | £735.99 |

Capital Gains Tax (CGT)

There are many silver coins issued by The Royal Mint which are British legal tender pound sterling. For example, silver Britannias are legal currency and CGT exempt. This means that when you come to sell, any profits made (as hopefully you made one) do not contribute to your CGT liability.

We highly recommend any UK investor to take advantage of this and we have a dedicated page for popular CGT exempt coins.

VAT

VAT is currently 20% on all new silver items bars or coins. For this reason alone, investors can be put off as gold is exempt!

We highly recommend buying second hand silver as we can offer these products on the margin scheme. We sell out very quickly of all second-hand silver so make sure to set a stock alert to be the first to find out when we add new stock to the website. These low prices can be offered through the second-hand special scheme and the deals are hard to beat!

We can offer VAT free silver in Switzerland but just be aware you cannot take delivery!

You can read more about this tax in our blog here.

Conclusion

We would usually recommend secondary market silver coins as the best value option since these carry the lowest premium. If you are interested in collecting coins for their appearance or rarity, then our recommendation changes. These second hand 1 ounce coins come at the best premiums, are usually available in large quantities and when you sell you will get a relatively good buy back rate. If you think you are going to go over the threshold for capital gains tax we would change our recommednation to our silver CGT Exempt Coins. You will pay slightly higher premiums per coin but this could be offset by not having to pay tax.

Further Reading

More information on investing in silver can be found in our silver guide.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.